External Sector

The external position of Kenya in 2020 was broadly in line with desirable policies: The current account deficit as share of GDP is estimated to have improved to 4.8 percent in 2020 from 5.8 percent in 2019 and is projected at 5.1 percent in 2021. This is mainly driven by strong remittances, solid horticultural exports and lower imports. As a result, the overall balance of payment position improved to a surplus of 1.5 percent of GDP in December 2020 from a deficit of 1.1 percent of GDP in December 2019. The official foreign exchange reserves held by the central Bank of Kenya declined to $8.0 billion by end-January 2021 and coverage remains adequate at 4.4 months of imports. An improvement in the Kenya’s competitiveness would be necessary to curtail the prolonged decline of the country’s share of world exports, attract private investments and hence improve overall economic performance.

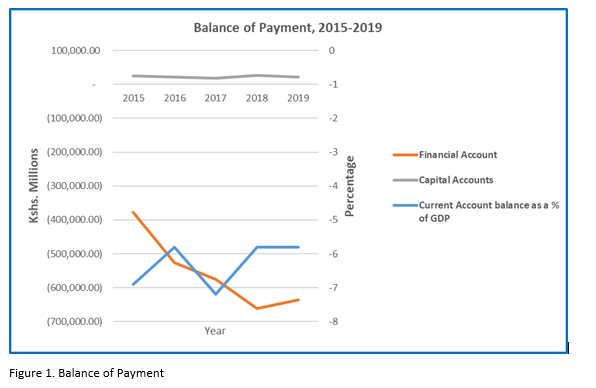

The Balance of Payments (BOP) current account worsened by 10.9 per cent to KSh 567.0 billion from KSh 511.3 billion in 2018 as shown in the excel below. This was occasioned by a 2.9 percent decline in merchandise exports to KSh 598.8 billion from Kshs 616.6 billion, a 2.3 percent increase in merchandise imports (f.o.b) to KSh 1,688.3 billion from Kshs. 1650 billion and a 33.7 percent worsening on the primary income account to a deficit of KSh 196.3 billion, in the review period. Growth in imports was mainly due to increased importation of petroleum products, and machinery and other capital equipment, in the year under review.

The current account balance as a percentage of GDP was -5.8% in 2019 as shown in Figure 1. Though Kenya current account balance as a share of GDP fluctuated substantially in recent years, it tended to decrease throughout the period. Financial Account has also sharply declined over the years.